What Would Happen if We Went on the Gold Standard Again

![]()

Recently, I've been reading nigh one of the "gold bugs'" favorite topics: the "gold standard." I've fifty-fifty had a plethora of comments on some of my articles from followers and SA users that imply "the cease is near, nosotros're headed back to the gold standard". It will never happen. But that doesn't mean I am not bullish on golden, I very much am.

My Favorite Gilded Anecdote

To grasp the long-term value of gold every bit a preservation of wealth tool, an investor need merely read this anecdote:

In the early on 1900s, a man with a 1-ounce Usa gold coin with a face value of $xx could purchase a very nice suit, shirt, belt, tie, and pair of shoes. Today, what could that $20 buy y'all - peradventure the chugalug? Nevertheless that ane ounce of gold, currently worth $1,964, tin still easily buy that human being a very dainty conform, shirt, chugalug, necktie, and pair of shoes. The bespeak is obvious: gold holds its value, and paper currencies practise not. Gold is a tool for the preservation of wealth.

US Debt

I am certainly not in denial about the US's massive debt load. In fact, I have mentioned it many times in my articles about gold. Indeed, deficits and the debt load were the master thesis of my article Gold: The Possibility Of A Trump-Induced Bull-Run right afterwards the election back in 2016 (aureate was under $1,200/oz at the time).

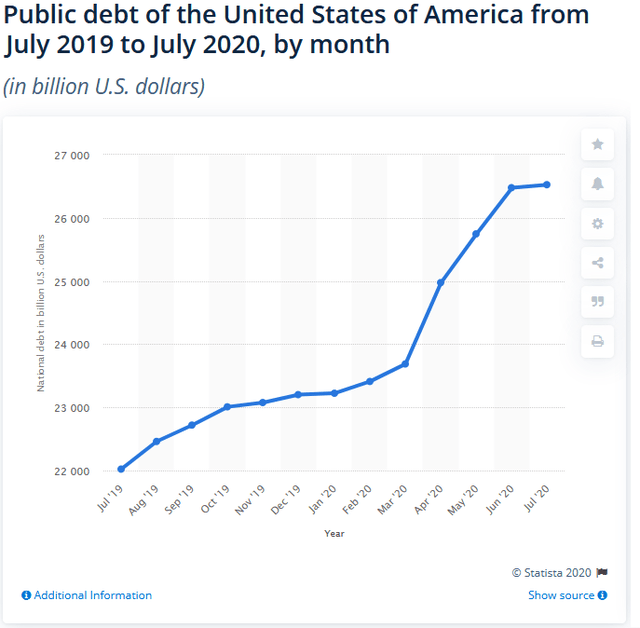

Permit us non forget, the US was already running ~$ane trillion annual federal deficits earlier COVID-19 hit, after all, massive taxation breaks for the super-rich and corporations don't come for gratuitous. But, of grade, COVID-19 has put the government US$ printing presses in high gear. According to Statistica.com, US public debt has risen 20% just over the by year:

Source: Statistica.com

As a result, and combined with the facts that:

- the US nonetheless has widespread COVID-xix infection and community transmission rates

- the United states of america has an unemployment charge per unit over 10%

- the United states has seen tens of thousands of small businesses close

- polls show upward to 40% of Americans wouldn't accept a COVID-nineteen vaccine if/when one was bachelor.

means the currency printing presses are not likely to slow downwards any time soon.

"Male monarch Dollar"

These developments have led some, including myself, to wonder if the US$ could lose its status as the global reserve currency of choice (run into Newmont: How To Profit From The Potential Terminate Of "King Dollar"). Since that article was published, many others have wondered aloud about the possibility (see this Reuters article). As expected, we have seen the The states$ dramatically weaken since the onset of the coronavirus and the lack of success in containing it:

Source: MarketWatch

Source: MarketWatch

Historically, global investors have embraced the US$ in times of crisis - and right afterward COVID-19 hit the U.s. in March - that again was the case. But since and so, the U.s.$ has sold off ten.4% from its high and is now down 4.4% YTD.

Combined with Fed chair Powell'south recent oral communication indicating the Fed's willingness to permit inflation run above its historical ii% target before raising interest rates. Lesser line (again) is that US interest rates are likely to stay low for a long, long fourth dimension. The skilful news: information technology makes the cost of issuing all that debt discussed previously much cheaper.

I was amazed to see gold sell off ~1% directly after the spoken communication and was wondering if everyone heard the same words from Powell that I heard. It was irrational, as the next day proved when gold turned around and gained nearly 2%.

The Gold Standard

All of these developments have prodded the aureate bugs to their favorite topic: bringing back the aureate standard. Yet, at that place is no indication that the US - let lone the world - would, or even could, bring back the gold standard. Back in 2017, I wrote the Seeking Alpha article The Price of Gold If The The states Was Still On The Aureate Standard. Feel gratis to read the details of the calculation, simply in brusk, the answer (at that time) was $v,228/ounce.

At the time, the US debt hadn't yet crossed $twenty trillion, and of course, the Fed balance sheet has greatly expanded as well. The point is that the magnitude of "the trouble" is, in a give-and-take, huge. Subsequently all, information technology was France exchanging its US$ currency annotation for gold that was the final harbinger that forced Nixon to end international convertibility of the U.S. dollar to gold on Baronial 15, 1971. Certainly, US gilded reserves take non kept pace with the rapid debasement of the US$ since so, so if it was a "problem" in 1971, information technology is a much bigger trouble today.

Yet some investors/historians want to revisit the empires of Rome and the UK and point out how debasement of those currencies led those powers losing their default status every bit the reserve currency of pick. They as well describe parallels with the path the United states of america empire is on today. No argument with me concerning history. That said, it doesn't mean the US, let alone the globe, will go back to the aureate standard anytime shortly. After all, the UK didn't go to the gold standard after the pound lost its position equally the world's leading currency. In fact, no country is on the gilded standard today, the final being Switzerland which left it two decades agone.

United states of america$: The Global Reserve Currency of Choice

All the same, "the problem" hasn't been all that bad (for the United states$...) because it has profoundly benefited from being the world'southward reserve currency of selection (sometimes referred to equally the "Exorbitant Privilege"). Here are iii big advantages:

- Being able to print the trillions and trillions of United states of america$ denominated debt and finding global investors to buy information technology.

- A tool for enabling the US to use a Us$ denominated global banking system to pressure strange countries - via sanctions or otherwise - to human action according to United states strange policy.

- Being able to run massive merchandise deficits.

Information technology also hasn't been "all bad" from the standpoint that millions of people effectually the planet have been lifted out of poverty during the reign of the United states of america$ (including hundreds of millions in China), opening upward large markets for U.s. products and services at the same time.

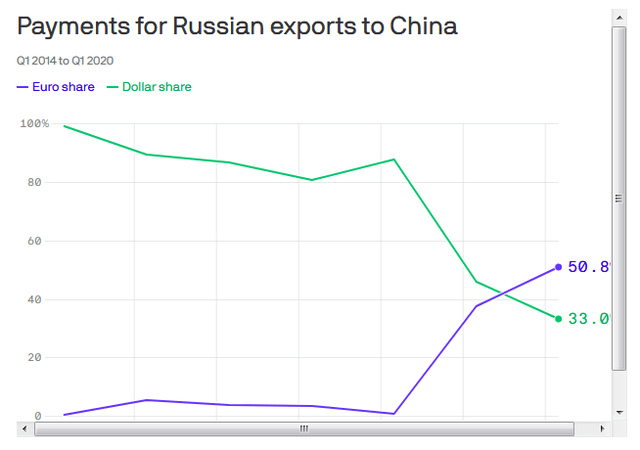

That said, many foreign countries that do not enjoy these privileges, and/or find themselves suffering equally a result of them, would like to come across a change and resent the massive debt the US has been able to rack upwards. Equally Axios currently reported, there'southward been a big modify in U.s.a.$ denominated trade between China and Russia, with the euro taking over:

Source: Axios

Source: Axios

In addition, Red china and Russian federation as well conduct energy trade betwixt themselves in their native currencies. And as I reported, in 2017, China - at present the world'due south #1 oil importer and #ii oil consumer - adult a new gilt-backed oil futures contract to specifically cut the United states of america$ out of those deals.

Special Drawing Rights ("SDRs")

Enter the "SDR" concept. Special Drawing Rights are supplementary strange exchange reserve assets defined supported and maintained past the International monetary fund ("IMF"). SDRs were created in 1969 to supplement a shortfall of preferred foreign exchange reserves - namely the US$ and gilt. SDRs (in XDR units) are a handbasket of 5 currencies:

There had been discussions to add together aureate and silver and perhaps other precious metals to the handbasket.

NOTE: Initially, its value was fixed at 1 XDR = 1 U.S. dollar (as equivalent to 0.888671 grams of fine gilded), just this was abandoned in favor of a currency basket later on the 1973 collapse of the Bretton Woods organisation of stock-still commutation rates.

And so, it'southward articulate, at least to me, that global finance ministers and the IMF have been tussling with "the problem" for decades now, and the best "solution" they came up with was SDRs. That is likely to exist the case in the future. And if the US loses its condition as the world's reserve currency, information technology is probable its % weighting in the SDR "basket" will autumn. It is also likely that if Cathay's economic system keeps growing, its weight in the handbasket volition rise (one reason I have invested in the SPDR South&P Red china ETF (GXC)).

Any investor investing in gilt simply for as a "hope and a dream" that the US, or the globe in general, volition render to the "gold standard" - that stopped working decades agone - volition likely be disappointed in that opinion. Just they will exist happy because they probable hold gold, and that will, I have no doubt, proceed to appreciate (especially in US$ terms). In fact, I think the popularity of Bitcoin is a sign that investors not simply don't believe a gold standard volition return, they believe well-designed digital currencies are the future.

It's Non An "Either/Or"

A person can believe that the The states won't go back to the gold standard (as I do) and withal exist bullish on aureate (as I am). The two are non mutually exclusive. I am bullish on gold because, as an American, my savings and investments are predominately based on a currency that is beingness rapidly debased. Equally a result, I desire to hedge that by buying gold and silvery and miners and investments like the GXC ETF. I've allocated a specific amount in my portfolio every bit a "preservation of wealth" bucket in case of a big drop in the US$. That bucket has done very well over the years.

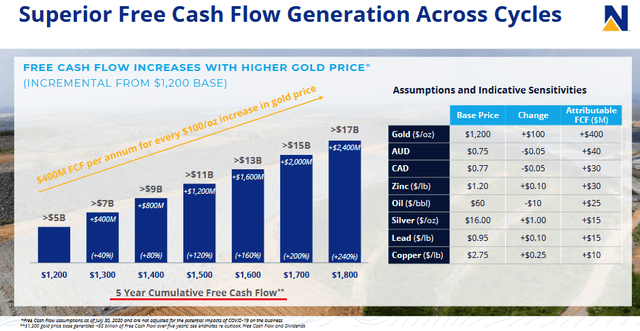

Newmont (NEM) is the only private mining stock I own; the rest I own through the Fidelity Select Gold Portfolio (FSAGX). I similar Newmont due to its tremendous free cash flow potential and a direction team that has proven itself to be shareholder-friendly. As a result, I expect pregnant dividend growth over the coming years.

The nautical chart below shows how nicely levered Newmont is to higher golden prices:

Source: Baronial Presentation

Source: Baronial Presentation

This chart is a fleck misleading, and so I underlined "5 Twelvemonth Cumulative FCF" in red. Non sure why the company presents the bar graph like that - I think information technology is their manner of telling shareholders they won't be running out of gold producing assets whatsoever fourth dimension soon. Perhaps, a better way to await at Newmont is by picking out the highlights of their Q2 EPS report:

- Produced 1.3 meg ounces of gold

- Had an AISC = $i,097/oz (all-in-sustaining toll)

- Had an average realized price for gold of $1,724

- Generated $388 1000000 of Free cash flow

Annotation that aureate is currently $200/oz+ college as compared to the Q2 average realized selling cost. Also, note that $388 million in FCF equates to $0.48/share (based on 805 1000000 fully diluted shares). The bodes well for near-term dividend growth, because the Q2 dividend was only $0.25/share.

Summary & Conclusion

The US, whether its currency loses its status as the global reserve currency of choice or not, will not be going back to the gold standard. Neither will whatever other country on Earth, in my opinion. What is probable to happen is that SDRs will play a growing and more of import role in global merchandise as the world moves away from the The states$. I also predict the Chinese yuan will likewise play an increasingly larger office in the basket of currencies that comprise an SDR.

What can Americans practise to preserve their wealth through such developments? Buy gold & silver bullion, but the GXC ETF, buy a mining stock similar Newmont, or purchase a aureate miners fund like FSAGX. Adept luck to you!

This article was written by

Technology stocks, ETFs, portfolio strategy, renewable free energy, and O&Chiliad companies. Primary goal is growing net-worth. I typically allocate a portion of my ain portfolio and devote some of my SA articles to small-scale and medium sized companies offering compelling risk/reward propositions. I am an Electronics Engineer, not a qualified investment advisor. While the data and data presented in my articles are obtained from company documents and/or sources believed to exist reliable, they have not been independently verified. Therefore, I cannot guarantee its accuracy. I advise investors conduct their own research and due-diligence and to consult a qualified investment advisor. I explicitly disclaim any liability that may arise from investment decisions yous make based on my articles. Thanks for reading and I wish you much investment success!

Disclosure: I am/nosotros are long GXC, FSAGX, NEM. I wrote this article myself, and it expresses my ain opinions. I am not receiving bounty for it (other than from Seeking Blastoff). I take no concern relationship with whatever company whose stock is mentioned in this commodity.

Additional disclosure: I am an engineer, not a CFA. The information and data presented in this commodity were obtained from company documents and/or sources believed to exist reliable, simply have non been independently verified. Therefore, the author cannot guarantee their accuracy. Delight do your ain research and contact a qualified investment advisor. I am not responsible for the investment decisions you brand.

kissingerloneve77.blogspot.com

Source: https://seekingalpha.com/article/4371805-u-s-dollar-back-on-gold-standard-never-happen

0 Response to "What Would Happen if We Went on the Gold Standard Again"

Post a Comment